travel nurse salary taxes

These stipends and reimbursements are for expenses such as meals parking transportation fees and housing. The good news though is that the standard deduction has increased offset partly by the elimination of the standard exemption and a significant percentage of travel nurses will pay less tax starting in 2018.

How To Make The Most Money As A Travel Nurse

This is how a.

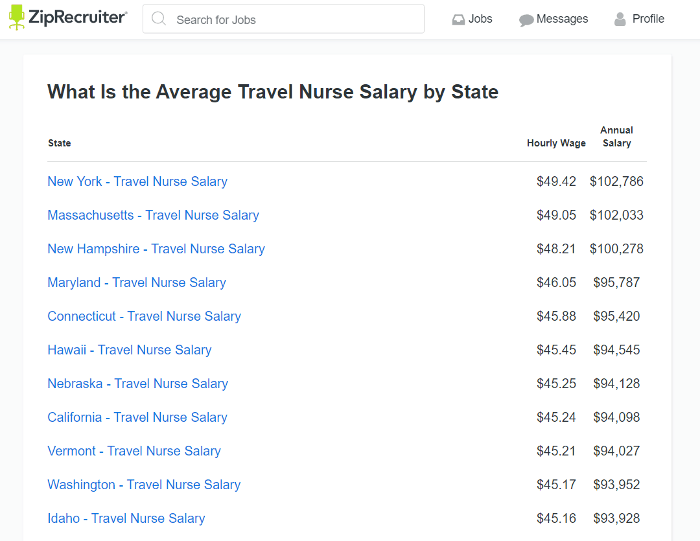

. On average they earn 117490 with a starting salary of 78430 rising to 170680 as more experience is gained. Across all states Wanderly has 27 travel ICU nurse jobs with a start date of April 30th 2018. Your home state taxes ALL income regardless of whether you worked there.

Averaging this data tells us that the average travel ICU nurse salary is 1852 per week or 96323 per year. For example if you live in Arizona and take a nursing job in Oregon that lasts for several months your tax home might end up being Oregon rather than Arizona simply because you spent more. Your listed bill rate typically takes all of this into account.

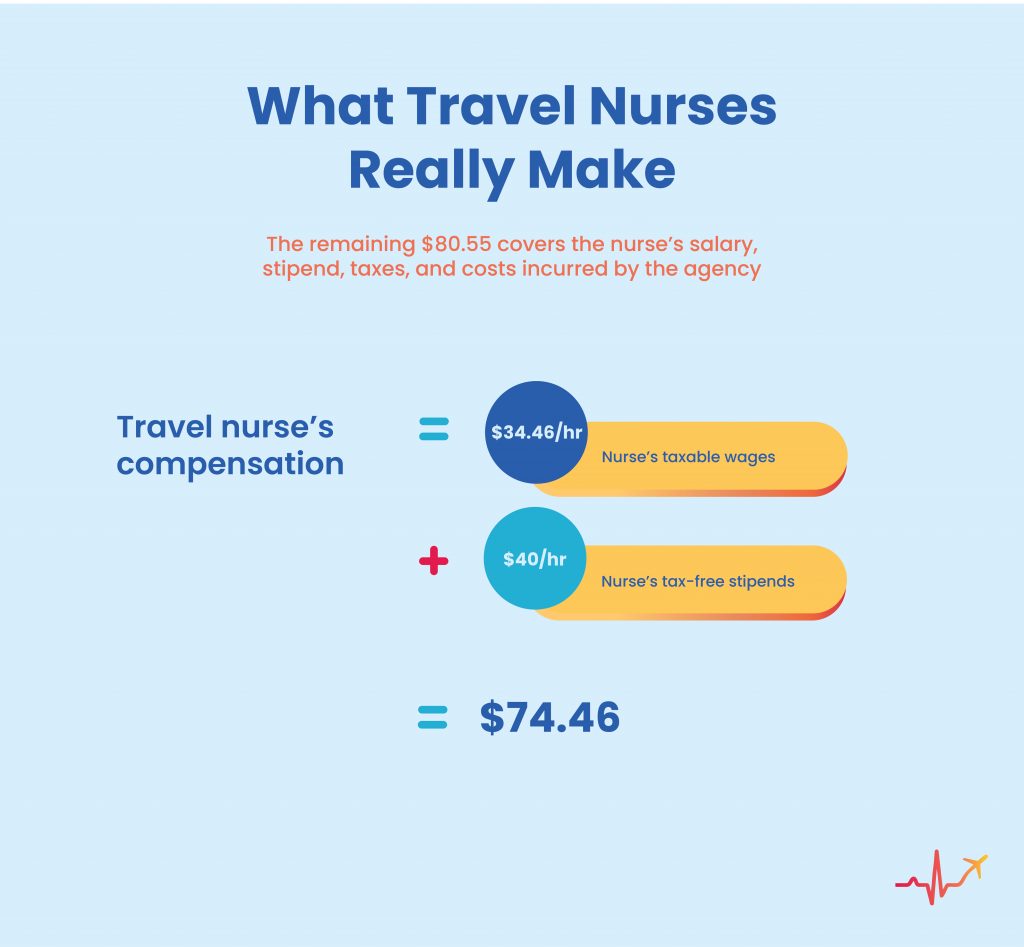

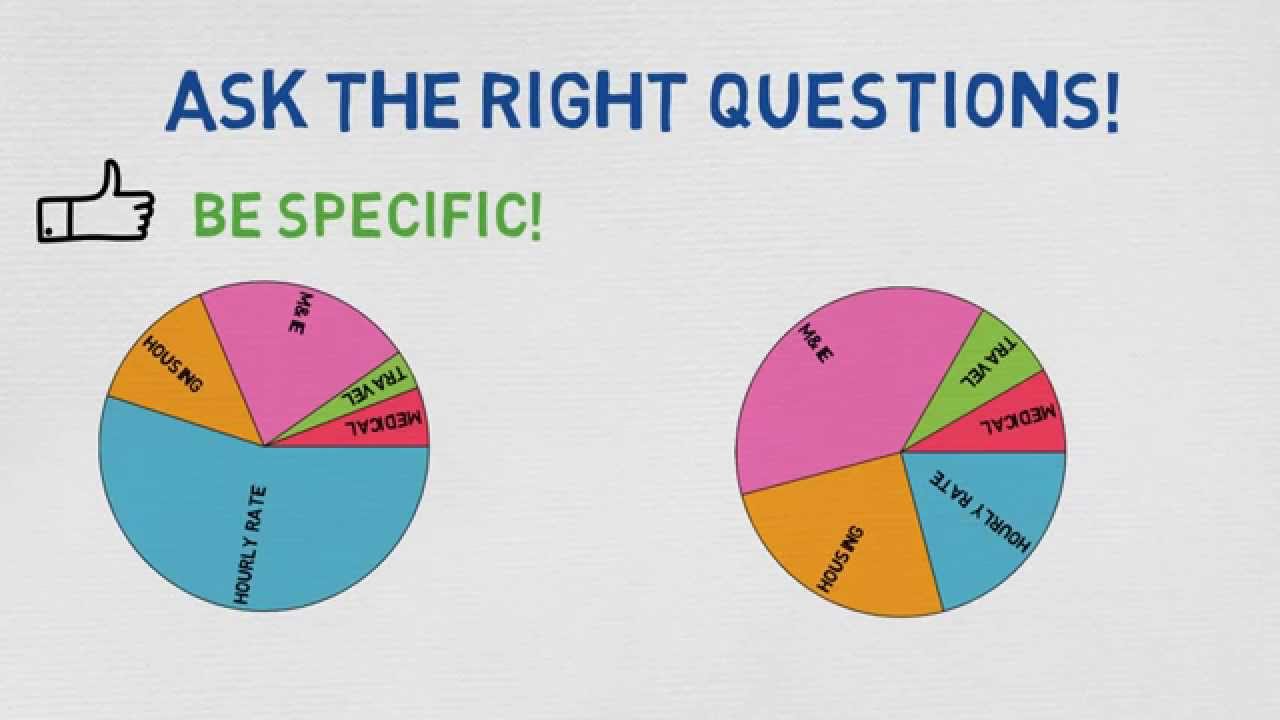

As mentioned above we simply subtract the estimated weekly taxes from the weekly taxable wage and add the remainder to the total weekly tax-free stipends to calculate weekly net pay for a contract. Travel nurses on the other hand receive a base rate and a reimbursement or an allowance for housing food and other travel expenses. The average monthly income for travel nurses is 9790 although this number can fluctuate based on factors such as the number of hours worked and any incentives receivedAnnual There is a wide range of variation in the annual compensation that travel nurses make on averageThey begin with a salary of 78430 but it may increase all the way up.

Tax break 1 The costs of maintaining your tax home. Your home state will credit you for taxes paid to the work states but if home state has a higher tax you must make up the difference. To find the take home pay 100-2080 6376hour 5101 per hour.

Have a permanent physical residence that you pay for and maintain. These reimbursements or stipends can be tax free with proof of an official tax home in your home state and duplication of expenses. For Sample 1 were looking at 720 16759.

To claim the tax benefits of being a travel nurse your tax home must fit these requirements. Estimated taxes or quarterly taxes should be 25 of the tax you expect to owe for the year. Your tax home is your fixed abode.

The IRS makes no such determination. Purveyors of this rule claim that it allows travel nurses to accept tax-free reimbursements as long as the travel assignment is 50 miles or more from the travel nurses tax home. 24 for taxable income between 85526 and 163300.

Example of take home pay from taxable income. The travel nurse pay breakdown can be calculated by dividing the 1500 in tax-free stipends by 36 the number of contracted hours per week the result is 4167 per hour worked. You must have regular employment in the area.

To get a good estimate of a travel ICU nurse salary we can average all travel ICU nurse salary data with a start date of April 30th. To find the taxable hourly rate 229530 weekly36 hours per week 6376 per hour. This means the TOTAL travel nurse pay rate is 6667 per hour.

This is how a lot of travel nurses handle taxes. 10 for the first 9875 in taxable income. The work state also taxes the income earned in their borders.

The monthly salary for travel nurses averages out to 9790 and may vary depending on hours worked or bonuses. There are some travel contracts offering overtime. One of the primary terms you will hear when filing your taxes as a traveling nurse is tax home Simply put your tax home is the state where you earn most of your nursing income.

In order to minimize the amount of tax you have to pay and to take advantage of the tax deductions for travel nurses you may qualify for you need to understand the ins and outs of the various tax write-offs for travel nurses. So if you make 20 and hour then your overtime pay will be 30 an hour. Without a tax home all travel lodging and meal per diems allowances stipends and the value of any provided housing is taxable for the individual nurse according to Smith.

For individual single taxpayers the new tax brackets that will apply to the tax returns filed in 2021 are. RNs can earn up to 2300 per week as a travel nurse. Spend at least 30 days of the year in that place.

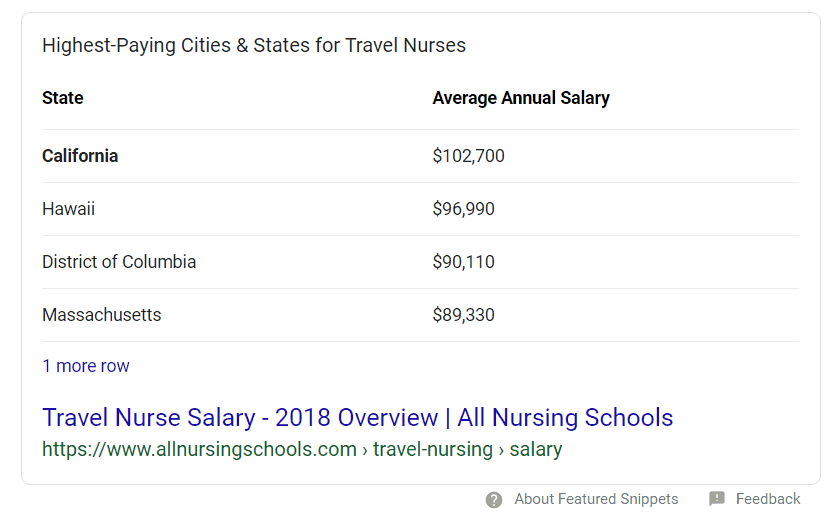

The average annual salary for travel nurses also varies significantly. This is because companies can legally reimburse its nurses for certain expenses incurred while working away from home you can think of these as travel expenses. You can also be part of the tax advantage plan in which some expenses are tax-deductible and some are non-taxable.

Travel nurse earnings can have a tax advantage. The monthly salary for travel nurses averages out to 9790 and may vary depending on hours worked or bonuses. 12 for taxable income between 9876 and 40125.

Overtime by law has to be paid time and a half of your taxable base rate. Your travel reimbursement usually comes in one lump sum of money and is nontaxable. From tax homes to keeping your receipts to knowing exactly how your income will affect your long-term financial goals here is the information you need to know about travel nurse taxes.

The average travel nurse salary varies greatly depending on the work assignment. Its prominent among both travel nurses and travel nursing recruiters. Depending on travel location these practitioners can earn between 3000 and 7000 per week averaging a 36-hour work week.

A 65 per hour pay rate works out to closer to 20 per hour of taxable income with the rest representing the non-taxable aspect. Typically there are stipends or reimbursements for travel nurses. 22 for taxable income between 40126 and 85525.

Navigating taxes can be a bit different for travel nurses compared to traditional staff nurses. For example some agencies will ask you if you want to work 4 days a week instead of 3 days a week. For an assignment to be considered temporary it must be expected to last less than one year.

This means that travel nurses will no longer be able to deduct any unreimbursed expenses related to their employment as a travel nurse. Travel nurse tax-free stipends are a huge perk. He added that agencies must have documentation of how they determined the tax-free portion of the pay packages so nurses should expect to provide expense records to their agency if requested.

Travel Nurse Overtime.

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

How Much Do Travel Nurses Make Factors That Stack On The Cash

Travel Nurse Tax Deductions What You Need To Know For 2018

Travel Nurse Salary Comparably

Travel Nurse Insight What Goes In To Pay Packages

What Is Travel Nursing Academia Labs

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

How To Calculate Travel Nursing Net Pay Bluepipes Blog

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

How To Evaluate Travel Nursing Pay Packages On Facebook Bluepipes Blog

Trusted Event Travel Nurse Taxes 101 Youtube

Everything About Travel Nursing Taxes And Tax Free Money Bluepipes Blog

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

Complete List Of Average Nursing And Travel Nursing Salaries By State By Nomad Health Nomad Health Medium

Travel Nurse Taxes How To Get The Highest Return Next Move Inc